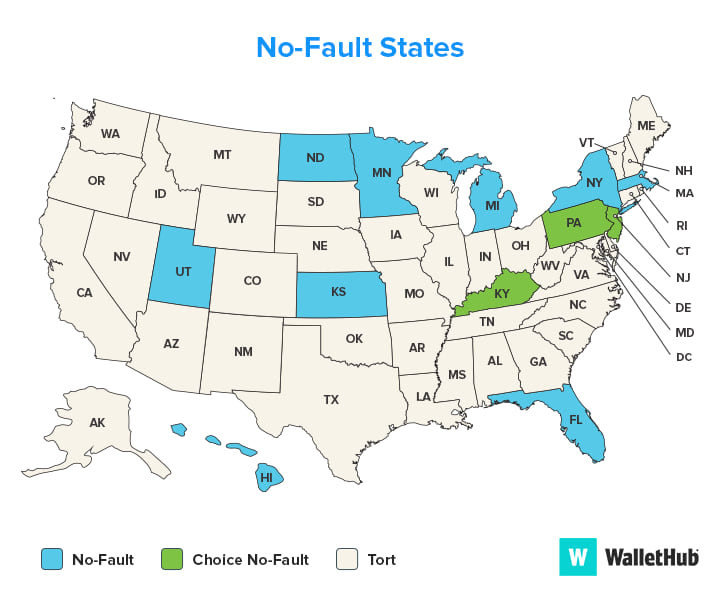

In the United States, vehicle insurance coverage legislations are a state-level choice. When it involves car crashes, a state can pick to be a choice no-fault state, a tort liability state or a mix. Recognizing the differences between these requireds can seem complicated, however we have actually damaged down both main categories, no-fault and tort, to aid make it simpler.

You may need no-fault auto insurance policy, and also having the appropriate quantity of no-fault automobile insurance could suggest the difference between being well-protected or being prone to a legal action or expensive out-of-pocket expenditure. What does a no-fault state mean? Drivers have insurance to cover their very own injuries as well as damages instead of insuring to pay out to the other individual.

Indicators on Is Colorado A No-fault State Or An At-fault State? - Denver ... You Should Know

In many no-fault accident states, vehicle drivers are required to have personal injury defense insurance coverage as component of their automobile insurance policy. The policies surrounding automobile mishap lawsuits in no-fault automobile states are strict.

No-fault states require different auto insurance coverage. Right here are the main differences in coverage demands for no-fault states: No-fault insurance policy pays for clinical expenses using personal injury security (PIP) protection.

Personal Injury Protection Coverage - Allstate - Car Insurance Fundamentals Explained

The insurer of the vehicle driver that triggers the crash is in charge of problems. Pros, Cons, At-fault cars and truck insurance states just require obligation insurance coverage. Responsibility insurance coverage does not shield your vehicle. No-fault states also need PIP protection. Insurance policy in at-fault states is usually extra costly due to the extra insurance coverage. You don't need to sue with your insurance firm in an at-fault insurance state if the mishap was brought on by someone else, saving you paying a deductible or greater costs.

This is a concern you can investigate online as well as validate by asking insurance coverage carriers in your state. If you live in Kentucky, New Jacket or Pennsylvania, inquire about selection no-fault insurance policy. This puts on states that enable motorists to pick in between a no-fault policy or a conventional tort (or at-fault) policy.

Our How Do No-fault Insurance Claims Work -Rainwater, Holt ... Diaries

If they pick typical tort, they are pulling out of no-fault. Unlike no-fault insurance, tort insurance requires that the regulation designates "mistake" as well as the person that is at fault is liable for all medical expenses, pain as well as suffering and also damage. You may have heard this kind of insurance policy referred to as "at-fault".

Car insurance coverage will pay up to the restrictions the insured chooses, however if the limits are tired, at-fault motorists are still reliant pay of pocket. Currently, 38 states (all states that are not no-fault) are tort liability states. See to it you recognize whether you'll be driving in an at-fault or no-fault car insurance policy state.

Some Known Facts About Exceptions To Florida No Fault Car Insurance Laws - Deloach ....

A no-fault insurance policy state sees less unimportant legal actions as a result of the restrictions imposed on suing somebody after a collision. When buying auto insurance coverage, there is more to consider than what service provider you'll choose and what your deductible and costs will certainly be. It is also important to recognize the car insurance laws in the state you reside in or any state you intend to relocate to.

There are also a number of states who take a hybrid technique by providing choice no-fault. Be prepared to ask your insurance coverage provider these essential concerns to ensure you have adequate insurance policy protection for your state.

The Of Fault And No-fault Car Accidents: Understanding Utah's ...

With a no-fault insurance claim, the normal policies for managing an insurer in a injury instance normally ought to be disregarded. For instance, most of the times, you do not wish to give a videotaped declaration to the opposite's insurance policy firm. However, in a no-fault insurance claim, state law normally requires you to accept your insurance provider.

Introduction No-fault car insurance coverage regulations require every motorist to sue with their own insurance provider after an accident, no matter of who was at fault. In states with no-fault laws, all vehicle drivers are needed to buy injury protection (PIP), as part of their car insurance coverage. In its strictest form, the term no-fault uses just to state legislations that both attend to the settlement of no-fault first-party benefits as well as limit the right to sue, the supposed "minimal tort" alternative.

The Definitive Guide to No-fault Insurance - Wikipedia

These problems, referred to as a limit, associate with the seriousness of injury. They may be revealed in verbal terms (a detailed or verbal threshold) or in buck amounts of clinical costs, a monetary threshold. Some regulations additionally consist of minimal needs for the days of disability incurred as a result of the crash.