This will lower your car insurance rates, making it much more budget friendly. If you choose the very first option, you will need to notify your partner that they can't drive your auto. If your partner drives your auto while they are intoxicated, and also the police officers draw him/her over, it can suggest huge problem.

Consult your state's cars and truck insurance coverage regulations to identify if you can omit your partner from your car insurance plan, as some states don't enable you to omit your companion if you reside in the exact same residence and also specifically if you are a wedded pair. The 2nd option might not be your very first choice, but you may have no choice, however to have your companion's name on your car insurance coverage.

We advise you to acquire vehicle insurance coverage on the much less costly vehicle from a various insurance provider and put in a request with your insurance provider to leave out the name of your companion from your cars and truck insurance plan on the automobile you drive. If you have one auto as well as both of you utilize it, you will need to provide the name of your companion and any type of other chauffeur such as your kids who are of driving age on your automobile insurance plan.

Will My Insurance Rates Go Up Because Of A Dui That Was ... - An Overview

If you have actually successfully excluded your companion from your car insurance plan, but he/she still drive your cars and truck, as we previously mentioned, it might indicate huge trouble for you. If your omitted companion enters into a vehicle mishap, your insurer has the complete right to decline your insurance claim. This implies you will certainly need to pay for the damages and injuries took place out of your very own pockets.

One more means to decrease your cars and truck insurance prices is to examine your vehicle insurance policy protection. Testimonial your vehicle insurance coverage to figure out if you are underinsured or over guaranteed. Examine your existing car insurance policy coverage to determine if you can afford to enhance your insurance deductible or can terminate a few of the added insurance coverage you have actually included to your policy, yet do not need them.

For circumstances, you don't drive your car a great deal, driving it less than 7,500 miles each year. If that holds true, discuss with your insurance company if you can obtain a reduced gas mileage vehicle insurance policy coverage. Simply put, if your companion has a DUI/DWI sentence, you will certainly attempt all the ways we have actually stated to attempt to minimize your automobile insurance policy costs, as after a sentence, the insurance coverage company views your companion as a liability.

The 5-Minute Rule for How Does A Dui Affect Your Car Insurance In New York State?

If you need to talk with a representative, please really feel cost-free to utilize the conversation function in the bottom left-hand corner or contact us at.

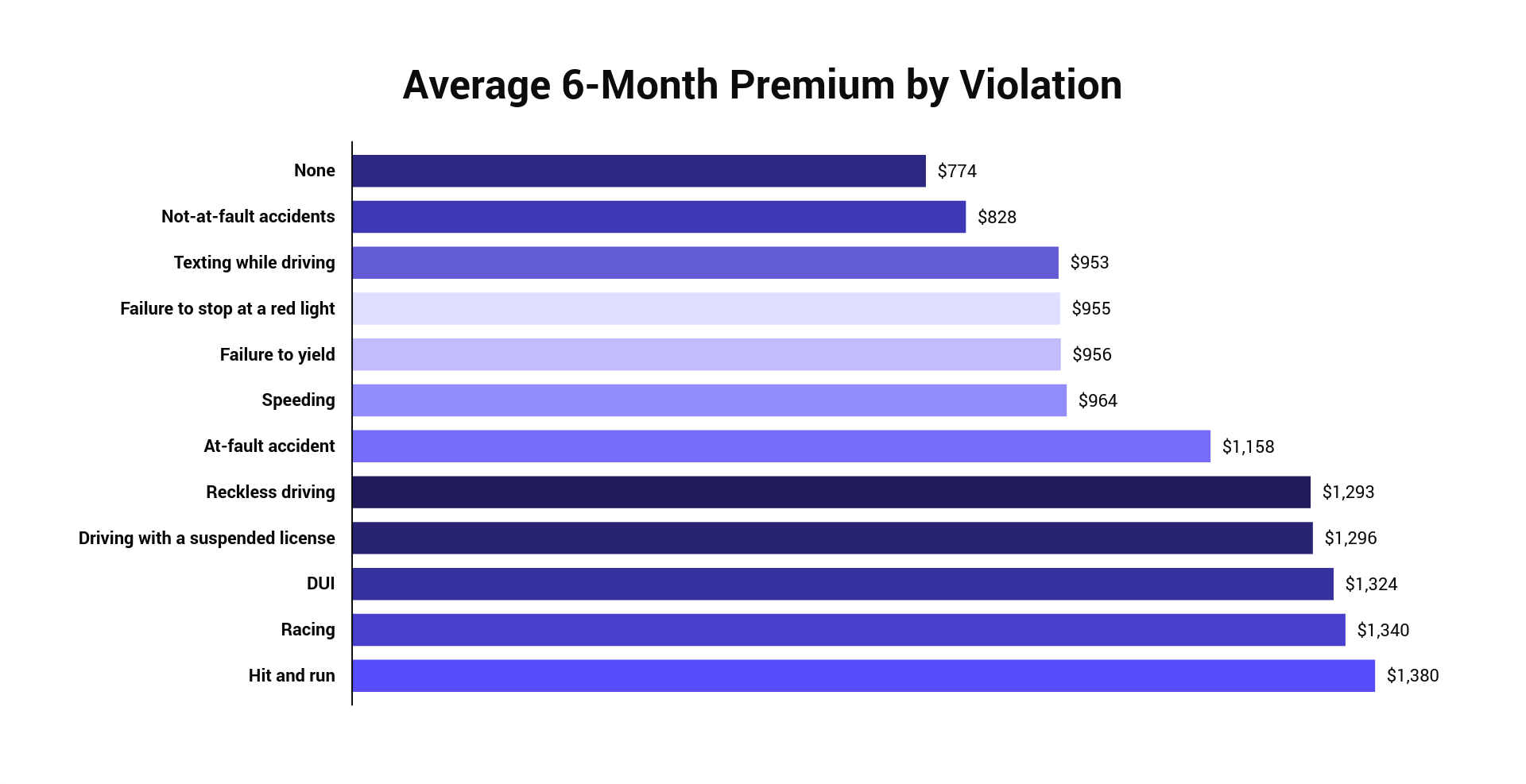

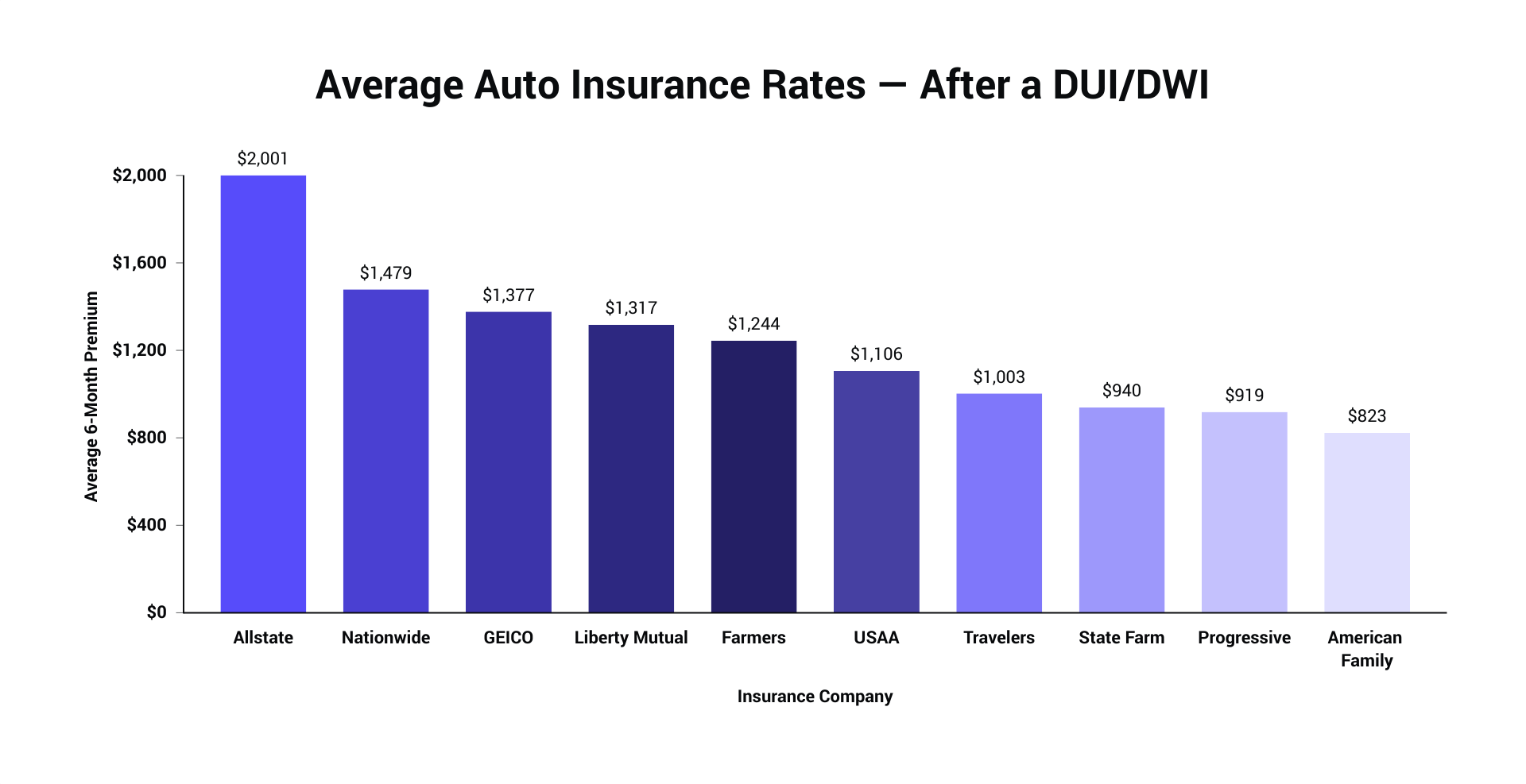

First, a DRUNK DRIVING sentence will certainly assure that your auto insurance coverage costs rates will certainly never be as low as they were prior to the conviction. Insurers are in business of 'risk' monitoring as well as the individual that has been found guilty of inebriated driving is currently classified 'high threat'. While it might not seem fair it is absolutely legal for insurance provider to dual or perhaps three-way your month-to-month costs.

There are numerous long-lasting effects of a DUI conviction. If you have been detained for a DWI in Texas, expect your automobile insurance policy prices to climb by a standard of $666 annually. Fortunately, Texas has several of the most affordable prices of boost for automobile insurance after a DRUNK DRIVING in the nation.

Some Ideas on Compare Dui Car Insurance [What To Expect] - Finder.com You Need To Know

One of the most typical procedure is for them to ahead a duplicate of an "SR-22 Proof of Insurance Coverage Certification" before they will withdraw a suspension of driving benefits. Afterwards, if the insurance coverage lapses or is terminated the state will certainly be informed and also the vehicle driver will be lawfully prohibited to drive until insurance policy is once again secured.

To start with one must be aggressive in maintaining a 'clean' driving record. Prevent any kind of future driving offenses such as speeding. As well, do not consume and drive once again this will only intensify your lawful and Check out the post right here insurance policy problems. You may also think about taking a safe-driving training course as well as forward this details to your insurer upon conclusion of the course.

These activities can favorably affect insurance coverage premiums. A DUI conviction is not the end of the globe but it might seem like it specifically when faced with boosted insurance policy premiums.

Getting My Find The Best Cheap Car Insurance After A Dui - 2021 Guide To Work

To find out more on the affects a DUI/DWI will have on your record, contact a Houston DUI lawyer at the Legislation Workplaces of David A. Breston.