When your plan lapses, other insurance carriers may end that you either can not make your payments promptly or are undependable. In any case, it can avoid you from getting a great plan at a budget friendly price. Some business will not authorize you for a policy at any type of cost since they see you as a risk.

Prior to you start collecting residence insurance coverage quotes, collect: Personal information like your chauffeur's permit as well as social safety number, Your address (if you recently moved or are moving as well as don't understand it off the top of your head)Info on Have a peek at this website any kind of current repair services or improvements to the residence, including the expense of those repair work or improvements, Details concerning your house's present condition (Is the roofing old? A house supply, Creating your home inventory, Your residence inventory should note whatever you have in your house or plan to keep there. condo insurance.

Whenever possible, affix invoices or assessments to your residence supply to reveal what the things deserve. If the item has a design number or serial number, include those as well. It seems laborious to make this residence supply, yet if you do as well as you provide it to your house insurance service provider, you ensure that whatever on the listing has coverage (homeowner insurance cheaper).

The provider will usually call you to set up a browse through so you can be house to allow the inspector in, but examinations can additionally take place without caution. Inspections normally take a couple of minutes to a couple of hrs depending upon exactly how huge your building is. Learn exactly how to review your plan, To ensure you have the right amount of protection, examine your house inventory with your representative. homeowner insurance.

Unfortunately, the majority of people just figure out they do not have sufficient insurance coverage after calamity strikes. End up being accustomed to what each section of your policy covers to make sure that you can describe it if you require to make a claim. What should my property owners insurance plan cover? According to the National Association of Insurance Policy Commissioners (NAIC), the majority of house policies contend the very least 6 areas that define sorts of insurance coverage.

Facts About 7 Features That Drive Up Homeowners Insurance Costs Revealed

This area covers various other structures on your residential property (home insurance). This can include sheds, separated garages and secure fencing. Section C covers the things that you keep in your home. This can consist of every little thing from high-end stereo devices to your kids's clothes. Like Section A, you have some adaptability below, so select an insurance coverage quantity that makes you really feel comfy.

Allow's claim that a fire loads your house with smoke and also causes extensive damage. Your household needs to move into a resort throughout house fixings. This section defines just how much cash you can get for those added costs, including your resort expense as well as dining establishment tabs since you won't have access to your cooking area.

It can help you cover the expense of a legal case if your neighbor trips and drops on your icy actions, as an example, or if your child tosses a round with the next-door neighbor's home window - inexpensive. If somebody obtains harmed on your residential property, Section F of your insurance plan secures you from medical expenses.

Without extra policies that cover these voids in protection, you do not have any security against some common catastrophes. All told, make certain you're putting various other policies in area wherever your house insurance protection leaves gaps.

insurance premiums deductibles affordable liability insurance insurance cheap

insurance premiums deductibles affordable liability insurance insurance cheap

The good news is, you can keep those costs to a minimum by contrasting house insurance coverage quotes. Your house insurance expense is special to you relying on where you live, your home and what you possess. The only way to understand you're obtaining the ideal residence insurance policy price is to collect several residence insurance policy prices estimate from various providers.

The 5-Minute Rule for Esurance Car Insurance Quotes & More

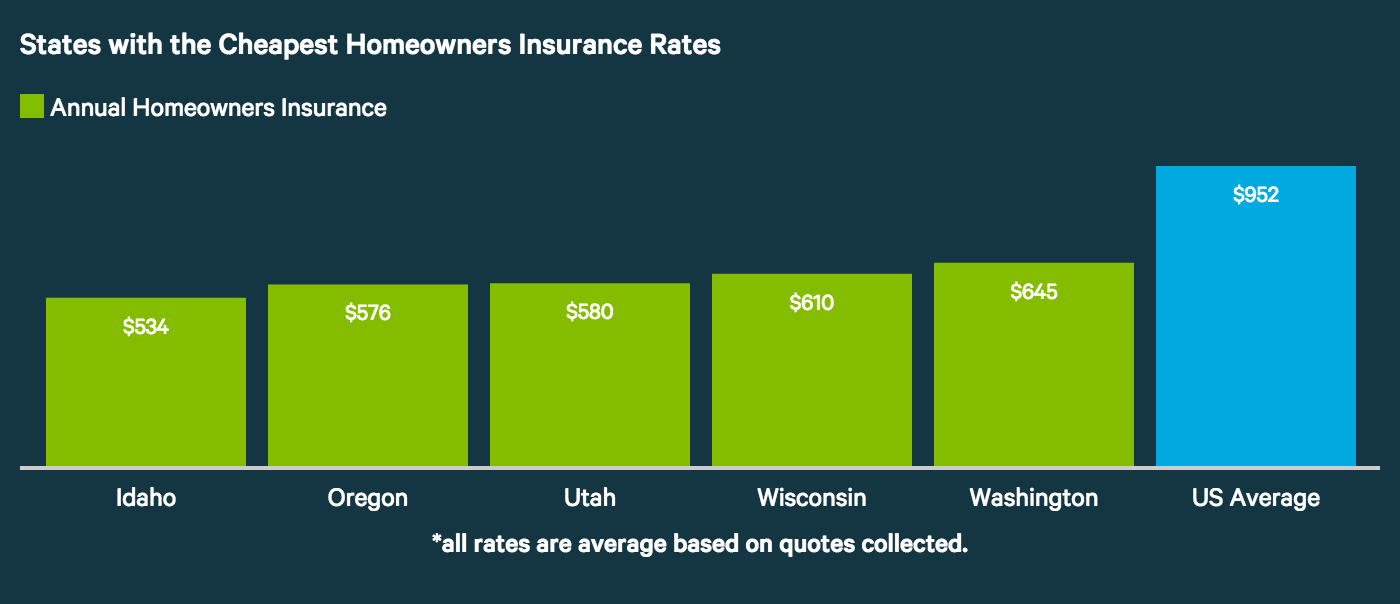

Incorporating plans you need like home and auto can help you rack up significant financial savings. Just how much does house owners insurance coverage price? The cost of your policy is going to depend upon you. That stated, recognizing some averages can help you shop educated. The ordinary property owner in the United States pays simply over $1,220 for their policy yearly.

If you could quickly relocate to your various other house, you might not need this protection. Individuals that own older residences, Do not assume that due to the fact that your residence is aging you don't need much coverage (affordable homeowners insurance). You intend to have enough home owners insurance policy to be able to reconstruct approximately your present top quality of life standards.

Young, single customers, A young adult that does not have any type of youngsters may not need as much insurance coverage as a family - liability insurance. When you don't require to fret concerning shielding youngsters and also other family participants, after that you can typically increase your insurance deductible, conserve more money and accept greater danger. Young households, If you start a family members, your insurance coverage needs may alter.

Locate a high quality company, Currently that you recognize what level of insurance coverage you need, you can begin contrasting firms and also policies - for home owners insurance. The NAIC will tell you whether an insurance policy firm has gotten issues regarding points like: Claim handling hold-ups, Case denials, Unsuitable negotiation offers, Terminating plans, Poor consumer solution, You can also call your state's Insurance coverage Compensation to find out even more about the insurance companies that offer your area as well as to find a listing of all licensed insurance agents and brokers.

You could have a couple of outliers (firms that bill exceptionally high or low rates), however many of them will certainly gather in a cost array. Beware of companies that provide exceptionally reduced prices.

The 10-Minute Rule for How Much Does Landlord Insurance Cost? - Steadily

a home insurance inexpensive for home insurance insurance companies finances

a home insurance inexpensive for home insurance insurance companies finances

Every one can have an effect on just how much you pay yearly. Increase your deductible, Your insurance deductible is the quantity of cash you have to invest out-of-pocket before the insurer starts footing the bill. Raising the insurance deductible makes you extra responsible and minimizes the insurance provider's danger. affordable.

Other memberships show insurance firms that you are the kind of customer they desire. You don't desire to miss any kind of means to lower your insurance prices.

Changing erratically from company to business can make you look dangerous. Insurance coverage business often share info with each other, so they understand that you leap from plan to plan (liability insurance). Never ever stop purchasing, Sticking with the very same residence insurer for numerous years can bring about more affordable prices. Still, this doesn't imply you need to always remain with the exact same firm forever.

By comparing insurer every couple of years, you can make certain that you never pay extra for the protection that you require. Just don't make a behavior of switching companies annually - deductible. The takeaway, You don't need to be an insurance expert to obtain a good offer on a home policy.

Scams does exist in the insurance world. You do not want to come down with deceitful business, Some qualified insurer provide much better solutions than others. deductibles. Make use of the NAIC database to ensure you select a firm with few complaints, And also to help you as you shop, right here's a fast reference of terms: The extra prices you sustain when you can't live in your home as a result of a covered reason and also from which your policy secures you The specific things your policy secures you versus The amount you pay out-of-pocket before your insurance coverage begins Your monetary obligation if a person obtains injured on your property or your reason property damage, The quantity of coverage your policy includes, after which you're responsible for all expenses, The quantity you spend for your insurance plan, As long as you keep these basic points in mind, you need to have the ability to browse the insurance policy globe without way too many problems.

Not known Incorrect Statements About Average Home Insurance Cost - Everquote

Purchasing house insurance coverage can feel demanding, however you have a lot more control over the circumstance than you recognize. Informed, wise buyers can make far better decisions than those who don't know just how to compare options or even obtain the info that they require to contrast policies. With this residence insurance policy guide, you're prepared to make a decision that will shield your house and family without spending even more money than essential.

Neighborhood Safety and security, When you're considering planting roots in a new town or city, it is necessary to comprehend simply exactly how safe your new neighborhood is. While there are lots of details you will certainly desire to ask your real estate professional regarding the community in order to make sure the safety of your house and also family members, two of the most important points to discover are just how far your house is from a fire hydrant and also what the distance is to the closest local fire department - a home owners insurance.

As a matter of fact, homes that lie in close proximity to fire hydrants and also a permanently staffed fire department can expect to pay much less in insurance policy. Furthermore, the number and extent of claims in your surrounding neighborhood can impact your policy also. That's why, if you are checking out residences along the water, which are much a lot more at risk to flooding, or in an area that has actually experienced a current spike in burglaries and vandalism, you will likely see this shown in higher house insurance prices.

That's because some providers consider particular breeds to be more aggressive, and for that reason even more of a danger to guarantee. To avoid a significant boost to your house insurance, however, your Morse insurance agent will certainly ask you about the history and personality of your four-legged buddy as well as attempt to place your policy with a service provider that is much more dog-friendly (cheap homeowners insurance).

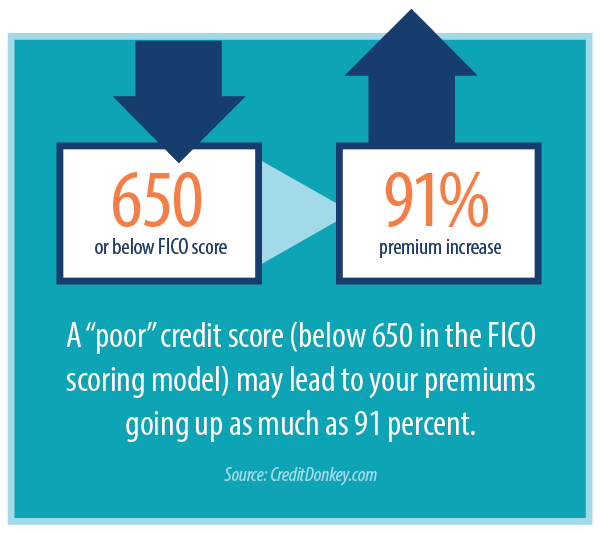

It's vital to recognize that your insurance coverage service provider will likely take right into account any previous insurance claims when determining your insurance policy costs. Insurance providers think that a history of claims, despite size as well as intensity, generally equates to a higher threat guaranteed. On the flip side, if you have actually shown that you're an accountable homeowner, with minimal to no claims on your document, you might be eligible for a reduced property owners rate in addition to a range of cost-saving discount rates - for home.

All About Cigna Official Site - Global Health Service Company

One means that we have the ability to lower your costs is by finding cost-saving price cuts via our pick team of leading nationwide insurance coverage providers (property insurance). Below are three of one of the most common discount rates available to house owners, yet we likewise have access to many other means you could be able to minimize your house insurance policy.

If you bundle your house and vehicle insurance coverage plans with the same insurer, most of the top service providers will award you with as much as 20 percent off your premium. It's tempting to shop around when your insurance coverage rates go up. By doing so, you may be missing out on out on the incentives that some insurance firms supply to their most faithful clients.

Installing smoke detectors, a burglar alarm as well as dead-bolt locks will not only enhance the overall protection of your residence but may additionally decrease your insurance costs. While the degree of cost savings varies amongst insurance coverage providers, you can anticipate to get anywhere from 5 to 20 percent off your costs for taking these easy safety and security actions in your home.

At Morse, we will not just take the required actions to develop you a proper home insurance coverage that fits your spending plan, but we will certainly likewise ensure that you know specifically what you are paying for. Whether you are in the market to acquire a brand-new house or you are a present homeowner that would like even more understanding into why you are paying what you are for residence insurance coverage, the devoted group at Morse would certainly enjoy nothing even more than the opportunity to satisfy with you, learn even more concerning your specific residence insurance needs, and also customize a home owners insurance policy that is just right for you.